What Percentage Is Taken From My Paycheck

As a new investor, it can sometimes be difficult to know exactly what percentage of your income you should invest.

5%? 10%? 15%? Who knows!

While everyone's circumstance is different, this article should give you a really good idea on what percentage of your income you should invest.

Before we get into things though, we need to clarify a few assumptions.

Assumption #1 – Your goal is to retire with at least $1,000,000.

Assumption #2 – You'll start investing by age 30.

Assumption #3 – You won't retire until age 65, unless you start investing before age 30. You'll want your investments to grow for 35 years.

Assumption #4 – You'll be able to generate an average return of 10%.

If you're over 30 years old, don't worry, you may have to invest a little more than someone who is younger than 30, but you'll be fine – we'll talk about this more later.

Quick Note #1

Another thing I want to point out here is that all these percentages you'll see below are based on your pre-tax income.

Okay, let's get into it.

As a general rule of thumb, you should always try to invest 15% of your pre-tax income. Assuming you start investing by age 30 and you generate a 10% average annual return while earning a minimum annual income of $21,500, you'll be retiring a millionaire at 65.

How exactly does that happen, you might ask?

If you make $21,500 a year, 15% of this equates to $3,225 per year or $268.75 per month.

And yeah, believe it or not, $268.75 invested every month for 35 years will make you a millionaire if you can generate a 10% average return over that time.

As you can tell, becoming a millionaire when you retire is very possible even if you don't earn a huge income. Always remember that.

But let's be honest though, most people reading this article will earn more than $21,500 per year during their working life. So putting aside 15% of your income, regardless of how much you make, will put you in great financial shape for your retirement.

Isn't that crazy to think? You could literally earn less than $22,000 a year for your entire life and become a millionaire?

In my article Investing Small Amounts of Money | Is it Worth It, I talk more about how investing even a very small amount of money consistently over a long period of time can result in massive wealth.

Tony Robbins tells an amazing story about a UPS worker who never made more than $14,000 a year in his lifetime but he invested 15% of his income every year and that amount eventually grew to over $70,000,000.

Check it out.

And no, he wasn't a professional investor. He just took advantage of compound interest over a long period of time.

Compound interest is often referred to as interest on your interest. I like to refer to it as growth on growth, but it means the same thing.

While I won't get into the nitty gritty of compound interest in this article, just know that it's the main reason why you can become very rich without ever making a lot of money.

All you need is a 15% of your income, solid investments returns, and most importantly, time.

With all that said, saying everyone should save exactly 15% of their income is a very blanket statement.

Not everyone makes the same income and not everyone starts investing at the same time, so I understand that 15% amount may not be necessarily for everyone.

So let's dig into this a little more.

First let's talk about how much income people should invest at different income levels.

What Percentage of Your Income Should You Invest – By Income Range

[$21,500 to $35,000]

As demonstrated above, earning $21,500 a year and investing 15% of your income for 35 years will put in millionaire status as long as you can generate an average return of 10%.

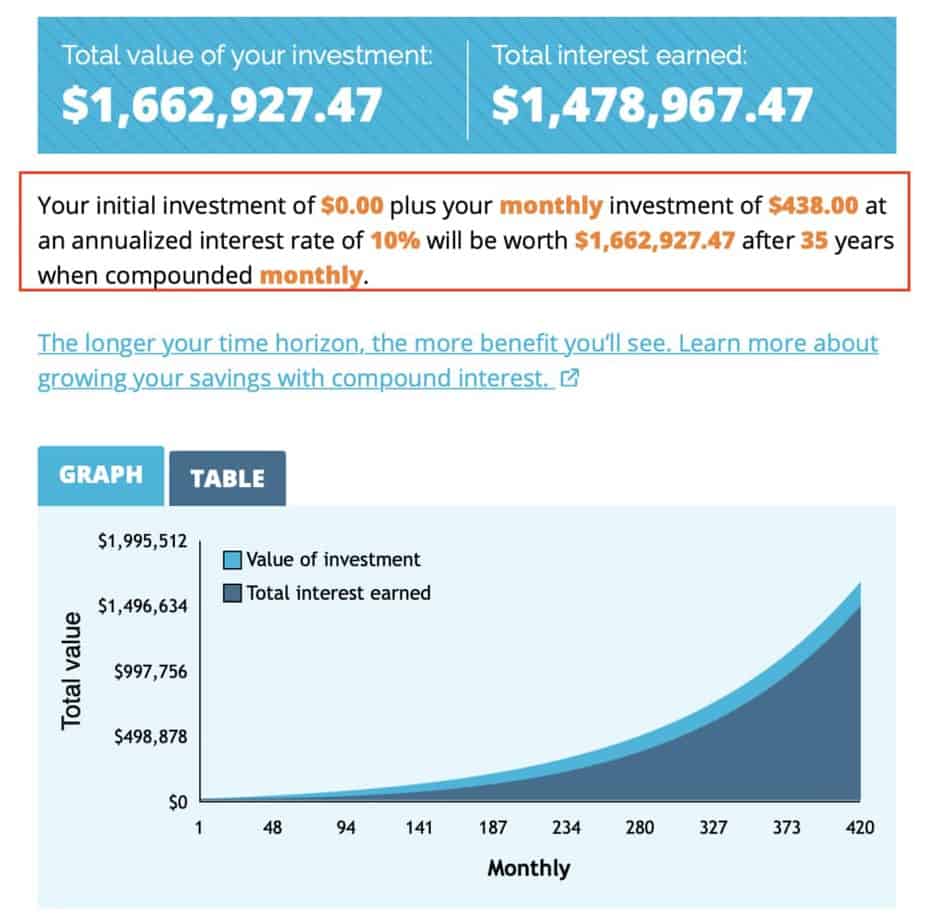

But what about if you make $35,000 a year? Well in that case you'll be contributing $438 per month and by the time you turn 65, you'll have roughly $1,663,000.

So with that said, if you make between $21,500 and $35,000 per year and you wish to retire a millionaire, you should save 15% of your income.

As shown above above, a $35,000 salary will put you well above the millionaire mark, but hey, having more money is not a bad thing.

And if you're making $35,000 a year, then you can certainly afford $438 a month.

Yes, you'll have to budget for it, but when it's for something this important, it shouldn't be too hard.

If you are living paycheck to paycheck and finding it hard to put away extra cash for investment purposes, check out my article How to Invest While Living Paycheck to Paycheck. In this article I outline a clear 5-step plan for how you can can achieve this.

[$35,001 to $50,000]

But what if you make more than $35,000 a year?

Well for one, great job! And for two, you might not need to invest the full 15% of your pre-tax income to retire a millionaire.

In fact, after running the numbers here is what I came up with:

- Investing 10% of your pre-tax income at $35,000 a year will still leave you with roughly $1,109,000 at age 65. Still a nice chunk of change above the 7-figures

- Investing 10% of your pre-tax income at $50,000 a year will leave you with roughly $1,583,000 at age 65. Another large cushion between you and the 1-million mark.

So, if you make anywhere from $35,001- $50,000 per year, you should invest 10% of your income for retirement if you want to retire comfortably a millionaire

[$50,001 to $70,000]

Generating anywhere from $50,001 to $70,000 a year is not a small feat, so if you are currently earning an income in this price range, give yourself a pat on the back.

But you're not reading this article for pats on the back are you, you want to know what percentage of your income you should invest.

- If you make $50,001 a year and invest 7% of this for 35 years at a 10% return, you'll have roughly $1,109,000.

- If you make $70,000 a year and invest 7% of this for 35 years at a 10% return, you'll have roughly $1,549,000. In other words, you are laughing!

I always like to be safe rather than sorry, so I find calculating an amount that just gets you to $1,000,000 is a dangerous play. One thing we know about investing is that predicting what will happen with the markets is often impossible.

So, if you make anywhere from $50,001-$70,000 per year, you should invest at least 7% of your pre-tax income in order to retire a millionaire.

[$70,001 +]

Now we're talking! If you make this kind of coin, bravo.

If you strive to make this kind of money someday, bravo, keep working, you can do it.

I'll keep this section short and just tell you what you'll need to invest in order to reach that 7 figure status by retirement – or 35 years, whichever comes first.

If you make over $70,000 a year, you should invest at least 5% of your pre-tax income in order to retire a millionaire.

Here's the quick math.

5% of $70,001 is $292 invested each month.

As shown earlier, $292 invested over 35 years at a 10% return will leave you with $1,109,000. Not bad hey.

So obviously if you earn anymore then $70,000 a year, with all else the same, you're going to be returning pretty comfortably at age 65 while not having to save a huge percentage of your income.

But again, it all depends on what your financial goals are.

If you are making over $70,000 for the better part of your working life, you might be accustomed to a higher end lifestyle than someone earning $50,000, so you'll probably want a little more money for retirement then they do.

Or maybe not, who knows, every situation is different.

I also want to point out that all these numbers are all based on the assumptions talked about at the beginning of this article.

Later on will talk about how you can calculate how much you should invest if these assumptions don't make sense for you.

I know I just threw a lot of numbers at you here, so allow me to bring it all together with a table below.

| Income | % Invested | Average Return | Investment Value |

|---|---|---|---|

| $21,500 – $35,000 | 15% | 10% | $1,02M – $1,66M |

| $35, 001 – $50,000 | 10% | 10% | $1,11M – $1,58M |

| $50,0001 – $70,000 | 7% | 10% | $1,11M – $1,55M |

| $70,0001 + | 5% | 10% | $1,11M + |

What Percentage of Your Income Should You Invest If You Start Late?

So one of the assumptions I gave at the beginning of this article was that you'd started investing by age 30.

But of course, the world isn't perfect and there is a very good chance a lot of people who read this article will be over the age of 30 and haven't begun to invest yet.

If this is you, I'm sorry.

But now I want to show you how you can figure out what percentage of your income you need to invest to reach your own unique goals.

First off, you're going to want to use this compound interest calculator tool that I've been using for my calculations above.

Then fill out the information as it pertains to your situation.

Maybe you already have some money saved up? Maybe you're 35 but you plan to retire at 55 – so "years to grow" will be 20.

Maybe you don't want to invest in high risk stocks but rather bonds and blue chips, so then you'd probably want to adjust your estimated interest rate to somewhere around 4%-6%.

And of course, you'll need to figure out how much you'll actually be investing and on what kind of basis.

Monthly, quarterly, annually? Whatever it is, make sure all your information is accurate.

You get the point. Once this is all filled out, you click "Calculate".

Then you'll see the "Total value of your investment" under the result tab.

This is the amount of money you'll have after the timeframe is up.

Obviously, this number is an estimate and not guaranteed by any means. But with that said, this should give you a pretty decent estimate on what your nest egg should look like years down the road.

So now, how does this estimated number look to you? Will you be able to comfortably retire with that amount?

If not, you're going to need either, contribute more money, increase your projected returns, or let compound interest work a little longer.

On the other hand, if you don't think you'll need that much to retire with, you can reduce your regular contribution amount, reduce your risk (lower returns), or you could even retire a little earlier than planned.

Play around with this tool until you find your sweet spot for these 3 factors:

- Regular Addition

- Interest Rate

- Years to Grow

Now to be frank – it doesn't really matter what the percentage of "regular addition" is relative to your income, but if you want to know this amount anyway, take the regular addition amount, annualize it, and then divide it by your annual net income.

For example, if your regular monthly addition is $1,000 and you make $100,000 a year, then you are investing 12% of your income.

$12,000 ($1,000 x 12 Months) / $100,000 = 12%

Does that all make sense? If not, just raise your hand and I'll come around. Lol.

Jokes aside, as you can see, you don't need me here trying to guess when you started investing, what your salary is and how much you'll want to retire with in order to get a good estimate on what percentage of your income you'll need to invest.

You can do it yourself much more accurately by following the steps above.

What If You Can't Afford to Invest?

I hear people say all the time "yeah, I have no extra money to invest right now, I'll just wait until I make more money"

Unfortunately, that day will never come. Not the day where you don't make more money, I'm sure that will happen.

But if you can't afford to invest now, you won't be able to afford it later, regardless of how much you make.

Everyone can afford to invest a percentage of their income, but you have to make it a priority.

It's like exercising, everyone has the same amount of hours in the day to fit in a workout, yet only some do.

Those who say they "don't have time" very well might not have time, but it's because it's not a main priority for them. They prioritize other aspects of their life to fill up their time with, which hey, that's fine.

But make investing a TOP PRIORITY.

After paying taxes, the next thing taken off your paycheck should go towards your investments THEN you live off what's left after that.

You see, most people do the opposite of this.

They live paycheck to paycheck and then save what's left after each month, which as we all know ends up being $0.

Pay yourself first. This method is often referred to as forced savings.

Failing to save any money can have serious consequences, some of which you may not even know about. In my article Harsh Consequences of Not Saving Money, I outline 6 of these drawbacks.

So if you've figured out how much you need to invest every month to reach your retirement goals, set up your accounts so this amount is automatically invested every month, and then live off whatever is left over.

Yeah, you might have to adjust your lifestyle a little bit, maybe cut back on fine dining twice a week, start biking to work, cancel your cable, I don't know – whatever it is, find a way to live off the income you earn AFTER you've contributed to your investment account each month.

And believe it or not, these cutbacks won't impact your happiness at all. You might think they would, but they really don't!

In fact, you might actually be happier!

Not only will you not feel the constant pressure of keeping up with the Joneses, but you'll also be happy in knowing your financial future looks bright.

So despite what you think, you can afford to invest, and I can say that confidently without even knowing how much you make- you just have to prioritize it.

If you are someone who is really bad with there money and just can't seem to figure out to properly manage their money, I'd highly recommend checking out my article How to Spend Your Money More Wisely | 11 Quick Tips.

The Bottom Line

You need to invest a percentage of your income if you want to retire financially independent.

While there are some exceptions such as inheriting a large sum of money or winning the lottery, those cases are few and far between – most of us will need some sort of nest egg to live off once we retire.

The question of "what percentage of your income should you invest" is very, very dependent on your situation.

If all the information given above was too much for you, I get it – just invest 15% of your income and move on. If you do this, you'll retire rich.

Personally, I do this. I invest 15% of my income in a tax-deferred retirement fund (RRSP). I make more than $70,000 a year, but I want to retire really wealthy.

If I die young, that's okay (financially speaking!), I've set things up so my siblings will inherit the money.

Not only that, but saving 15% of my income still allows me to live comfortably within my means while looking forward to my retirement years – because I know that I'll be able to do whatever the sweet **ck I want!

On that note – Geek, out.

What Percentage Is Taken From My Paycheck

Source: https://thefinancialgeek.com/blog/what-percentage-of-your-income-should-you-invest-by-salary-range/

0 Response to "What Percentage Is Taken From My Paycheck"

Post a Comment